Benefits of Diversification Elegantly Quantified

Time horizon, diversification and a portfolio allocation that balances risk tolerance and financial goals are the three basic pillars to long term investing success. The benefits of diversification were quantified and understood in 1952 when Modern Portfolio Theory was developed by Dr. Harry Markowitz, work for which he was awarded the Nobel Prize in Economics in 1990. Since then, diversification has become fundamental to the practice of responsible professional investment management.

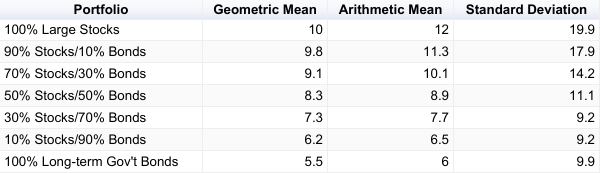

Conceptually diversification has been around for centuries and is easy to understand. We have all heard the old saying 'Don't put all your eggs in one basket'. Concretely demonstrating the actual benefits of diversification is more difficult due to the complexity of the mathematics involved. The table presented below elegantly solves this problem by showing the results of a basic, dual asset portfolio constructed with different allocations of US Large Stocks and US Long-term Government Bonds from 1926 to 2016.

Geometric Mean = Compounded Annual Rate of Return

Arithmetic Mean = Average Annual Rate of Return

Standard Deviation = Volatility or 'Riskiness' of the Annual Return

At first glance the table confirms conventional wisdom, that stocks have higher returns than bonds and greater risk. As you add more bonds to the portfolio the levels of risk, and consequently return, are reduced. The two go hand in hand. The stunning insight, however, is that a portfolio comprised solely of bonds is actually more risky and has a lower return than the portfolio with a 30% allocation to stocks. Effectively, diversification can make the riskiness of the overall portfolio lower than the risk of its least risky component.

If we were solely optimizing the portfolio for the lowest risk the choice would be 30% Stocks/70% Bonds. In reality risk tolerance and time horizon also influence the choice of asset allocation. For investors with aggressive risk tolerance or long time horizons a higher risk, higher return portfolio would be more suitable. Conversely, someone in retirement living on the cash flow from the portfolio would choose even less risky, shorter term bonds. In all cases mathematical theory, decades of hard data and common sense all tell us that a key component to long term investment success is diversification.

2017 Stocks, Bonds, Bills and Inflation Yearbook published by Duff and Phelps (1926-2016)

Exhibit 2.11: Portfolio Summary Statistics of Annual Returns

(Always Rebalanced) (% per annum)

Sumit Kumar, Greenwich CT